GST is one tax for the complete nation, that makes Asian nation a typical unified market. GST subsumes most indirect taxes below one taxation regime. Right from the manufacturer to the patron, GST could be a revenue enhancement on the availability of products and services. the worth of GST is of nice importance as each the governments (central and state) ar currently counting on the GST for his or her tax revenue. take benefits of GST Software By Government.

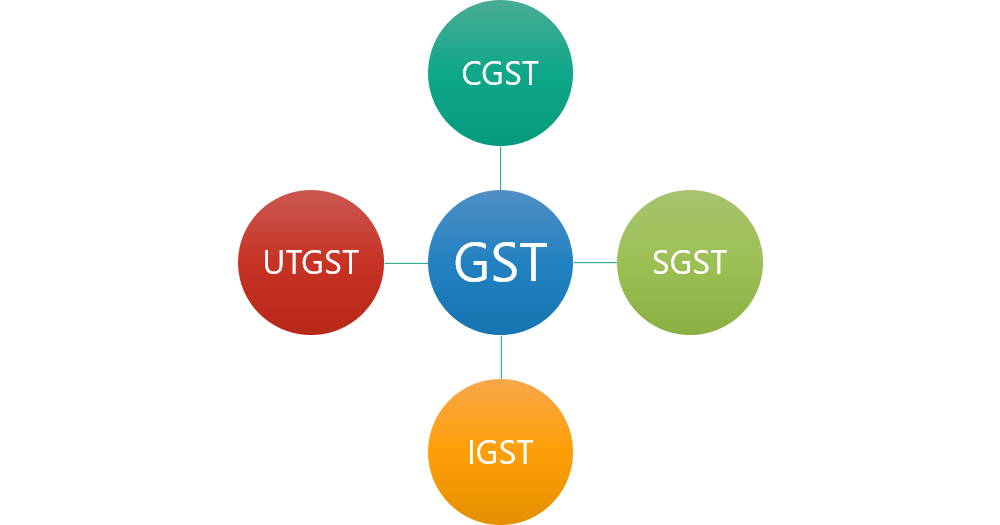

There are four major types of GST that include:

- The State Goods and Services Tax (SGST)

- The Central Goods and Services Tax (CGST)

- The Union Territory Goods and Services Tax (UTGST)

- The Integrated Goods and Services Tax (IGST)

1.The State Goods and Services Tax (SGST)

SGST is one of the two taxes that is imposed on every state’s transaction of goods and services. It is levied by the state where the goods are being sold or obtained. It thus replaces all kinds of existing state taxes including the VAT, the Entertainment Tax, Luxury, Sales Tax, Entry Tax etc. and the Surcharges on any kind of transactions that are being made with the involvement of goods and services. The main claimer of the revenue which is earned under the SGST is the State Government. know more about softwares and take benefits of GST Software By Government also.

Let us take an example:

Nehal may be a dealer in geographic area World Health Organization sold product to Amar in geographic area price Rs. 20,000. The GST rate is eighteen that has September 11 of CGST and September 11 of SGST. In such a case, the dealer collects Rs. 20,000 + 3,600 (GST) of that Rs. 1800 can visit the Central Government and Rs. 1,800 can visit the geographic area Government. GST Software By Government is available.

2.The Central Goods and Services Tax (CGST)

CGST refers to the Central GST tax that’s obligatory by the Central Government of Bharat on transactions of products and services that happen among a state. CGST is one among of} the 2 taxes that’s charged on every intrastate (within one state) group action, the opposite one being SGST (or UTGST for Union Territories). CGST replaces all alternative existing Central taxes together with Service Tax, Central Excise Duty, CST, SAD, etc. the speed of CGST is that the same as of SGST wherever each taxes square measure charged on the bottom value of the merchandise.

Let us take an example:

In the above-stated example, once Raman oversubscribed product to Amar within the same state (Maharashtra), Amar paid 2 taxes wherever CGST was for the central government and SGST was for the authorities and therefore the rate of each square measure same i.e. 9%. once the applying of CGST (9% of Rs twenty,000), the ultimate value of the merchandise becomes Rs twenty three,600.

Here, all the taxes all told the things on top of square measure borne by the tip shopper within the final value and not by the manufacturer or the dealer of the merchandise or service. Since GST is levied wherever consumption is concerned, the state wherever the merchandise is originally factory-made isn’t entitled to the taxman. If the producing state imposes a tax, the Central government can transfer an equivalent to the overwhelming state.

3.The Integrated Goods and Services Tax (IGST)

IGST or The Integrated Goods and Services Tax is applicable when the interstate transactions of goods and services take place. IGST is also imposed on the goods that are imported which gets distributed amongst the respective states. The IGST is charged when the movement of any product or service takes place from one state to another.

Let us take an example:

Nehal who is a manufacturer in Maharashtra is selling his goods of 20,000 worth to Amar who resides in Delhi. As this is an interstate transaction, IGST will be applicable here. As the GST rate is 18%, the IGST amount chargeable will be Rs 3,600 (18% of Rs 20,000) and the refined rate of the product itself will be Rs 23,600. GST is fundamentally a consumption tax which means that only the state where the goods are actually consumed will be getting the due benefits, setting aside the manufacturing state.

4. The Union Territory Goods and Services Tax (UTGST)

The Union Territory merchandise and Services Tax normally called UTGST is applied to the provision of products and services in any of the 5 Indian Union Territories as well as Chandigarh, Andaman and Nicobar Islands, Dadra and Nagar Haveli, Lakshadweep and Daman and Diu. UTGST is being charged in addition with Central GST (CGST). For any of the products or services dealings at intervals a Union Territory, the add of CGST and UGST is taken into account.

Territory, the add of CGST and UGST is taken into account. the explanation behind the separate implementation of GST for the Union Territories is that the common State GST (SGST) can’t be applied in an exceedingly Union territory with none legal authority. SGST is applicable to city and Pondicherry as they have already got their own legal authorities.

Registering for GST is currently potential with a simple on-line method through cost-efficient and top-grade services offered by Alankit restricted, a certified GST Suvidha supplier (GSP) with twenty years of trade expertise. Alankit, with its team of practised GST consultants, provides practice services and solutions to all or any GST connected queries.