Manage your business professionally with GST Billing Software. Using the best software for your billing, inventory & accounting needs. Be a part of 1 Cr+ SMEs in India who trust GST Billing Software.

Happy customers

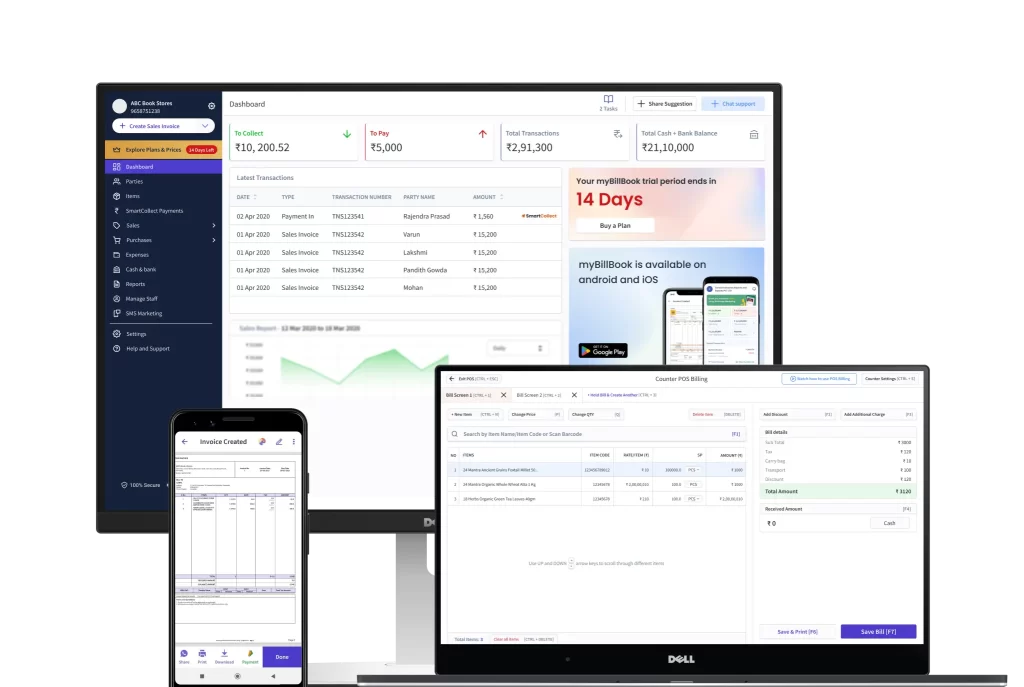

Android Mobile App

on Google Play Store

Use together on Mobile/Desktop

User Management Feature

GST Billing Software helps you set up a professional brand identity with useful GST billing features. You can use GST Billing Software accounting and billing app to create invoices. It helps you comply with Goods and Service Tax law in India.

GST Billing Software makes accounting error-free. It helps ensure data security for your business. In a few steps, invoice formats in the GST billing software app help create GST invoices. You can use the GST billing software in both online and offline modes. So, using the app makes it easier for an SME to comply with the best accounting practices. It makes the bookkeeping process seamless for businesses.

Using our free billing software, you can easily create useful documents. It includes quotations, estimates, and accurate GST invoices. Inbuilt features in the GST billing app allow you to send quotes/estimates to customers anytime. You can send them directly through WhatsApp, email, SMS, or by printing.

Using our advanced GST Compliant Software for Billing makes creating sales or purchase orders easier. It helps set up a due date for tracking order seamlessly. With this GST Accounting and Billing Software, we get an auto stock adjustment. It help ensure the availability of inventory items.

When moving goods worth more than Rs. 50,000 for supply-related purposes, for purposes other than supply, or as a result of an inward supply from an unregistered person, the way bill (a document to be carried by the person in charge of conveyance) is generated electronically using the E-Way bill system for GST registered persons and enrolled transporters.

Tracking and recording all expenses in the business is important for accounting and tax filing. It is easier to follow the money spent and create an accurate report with the GST billing software.

Get acknowledgement upon delivery with “Delivery Challan” of GST billing software. Create delivery challans and attach them with your consignment using this free GST invoicing app.

The free online barcode maker for Code-128 generates both 1D and 2D barcodes. Download the bitmap or vector version of the created barcode.

Businesses can easily add, manage, and track online and offline payments quickly. If they opt for an easy-to-use free GST billing app for mobile, the tasks gets easier. Whether your revenue is from the banks or e-wallets, you can seamlessly enter data into the free billing software.

Various report can be exported in excel/pdf sale report, purchase report,party statement, Profit&loss Sheet, GST Reprts, GSTR1, GSTR2, GSTR3B, GSTR 9.

Our all-in-one free GST billing software is an excellent addition to your business as it helps you automate your billing requirements. It is pretty efficient in assisting medium and small enterprises to save more time in accounting.

Whether you require your invoice in the perfect format instead of bill format or Excel format, this free billing software is the best. GST billing software is compatible with thermal and regular (laser) printers and can help you get your desired printout within minutes.

Set up your online store within a few hours using the GST billing software. Using our mobile billing app, you can list all the services/products you sell to your customers online, and it will help you present a catalogue of all the services/products you sell and boost your sales online.

Auto back/ Backup to Computer /Backup to Drive / Restore backup. GST billing & accounting Software is 100% secure, and you can easily store your data accurately. Our free app lets you keep your data secure by creating local, external or online Google Drive backups.

Using our GST billing software, you can keep track of available items in your store. It can help you set up low inventory alerts to place advance orders and detect possible theft.

Your customers are less likely to default on the payments if you provide multiple payment options for convenience.

GST billing software business dashboard makes the entire management process seamless. You can check business cash flow, inventory status, open orders, and payment updates in one place.

Using our free GST software for billing in India, you can set up an automatic data backup, allowing you to safeguard the data stored in the app. For additional safety, you can create a local backup too.

GST billing & accounting software allows businesses to record transactions. It helps track payments. Over 1 crore businesses have tried out our free billing software features.

Providing professional quotes and estimates during negotiation builds a positive brand image. Further, you can provide complete disclosure about the deal to build trust.

For managing vendors, employees, and retail stores, use Paytm POS Billing Software. For small and large organizations, online invoicing is available.

Using our billing tool, you need not stop business operations due to weak internet connectivity. You can use the offline billing features in the app to generate bills.

e-Invoicing under GST denotes electronic invoicing defined by the GST law. Just like how a GST-registered business uses an e-way bill while transporting goods from one place to another. Similarly, certain notified GST-registered businesses must generate e invoice for Business-to-Business (B2B) transactions.

e-Invoicing under GST denotes electronic invoicing defined by the GST law. Just like how a GST-registered business uses an e-way bill while transporting goods from one place to another. Similarly, certain notified GST-registered businesses must generate e invoice for Business-to-Business (B2B) transactions.

GST Billing Software is a popular billing and accounting software designed for small and medium-sized businesses, particularly in India. It offers a range of features to help businesses manage their invoicing, accounting, and inventory needs.